HMRC recently released the draft legislation for Research and Development (R&D) Tax Relief following various announcements of changes to the SME and RDEC schemes, which are due to be implemented in April of this year.

We have summarised the key points from the draft legislation and explained how the proposed changes could impact your future claims.

Claiming overseas expenditure

For accounting periods starting on or after 1 April 2023, expenditure for overseas subcontractors or externally provided workers (EPWs) will no longer qualify for R&D tax relief. The aim of this is to refocus and promote innovation within the UK.

There are some exceptions to this rule. If subcontractor costs relate to activities undertaken in the UK or for a UK-based R&D project (by an overseas subcontractor) the costs may still qualify. Additionally, subcontractor costs incurred overseas may also still qualify if all three of these conditions for qualifying overseas expenditure are met:

- The necessary conditions for your R&D activities are not available in the UK. For example, for legal, social, or geographical reasons, such as deep-sea research.

- The necessary conditions are available in the location where your R&D activity is being conducted.

- It is completely unreasonable for the conditions to be replicated within the UK. For example, if you are conducting climate specific testing abroad, which cannot take place in the UK.

Data, cloud & mathematics costs

For accounting periods starting on or after 1 April 2023, data and cloud computing costs will qualify for relief. We are still awaiting the publication of further guidance as to the detail of exactly which elements qualify. However, there are some costs which have already been confirmed to be outside of the scope for an R&D claim, these include:

- Costs that your Company can recoup. For example, if you are incurring the costs for the data but selling it on.

- If you have a contractual right to communicate the data with third particles, such as publications.

- If you operate your own cloud data services, set up costs will not qualify for relief, but costs for operating facilities might.

Pure mathematics will also qualify, however HMRC are yet to provide information on the details.

Provision of additional information

If you are submitting a claim, you will have to complete an ‘Additional Information’ form either along with or in advance of your submission. The form has not yet been released and HMRC are still to confirm if the form will replace the reports that have been requested previously.

The form will outline details regarding the projects, costs, the team members involved, and the agent who supported the Company throughout the claim process.

Identifying the baseline of science and technology you aim to advance, the uncertainties involved in the project, and how you attempted to overcome them will now be required for all R&D claims. The level of expenditure associated with each project must also be included within the report.

At Breakthrough Associates, our reports already cover the level of detail requested by HMRC. We ensure all relevant associated costs per project are captured and presented clearly to HMRC.

New pre-notification requirement

If you have not claimed R&D relief previously or within the last three years, you must notify HMRC of your intention to submit a claim within six months at the end of the accounting period. For example, for a year end of 31 March 2024, you must confirm with HMRC your intention to submit an R&D claim by 30 September 2023.

This is currently being debated as the House of Lords committee does not agree with this suggestion – watch this space!

Changes to benefit structure

In the Autumn Statement 2022, the Chancellor announced significant changes to both the SME and Research and Development Expenditure Credit (RDEC) Schemes in terms of the calculation of the benefit for companies who claim.

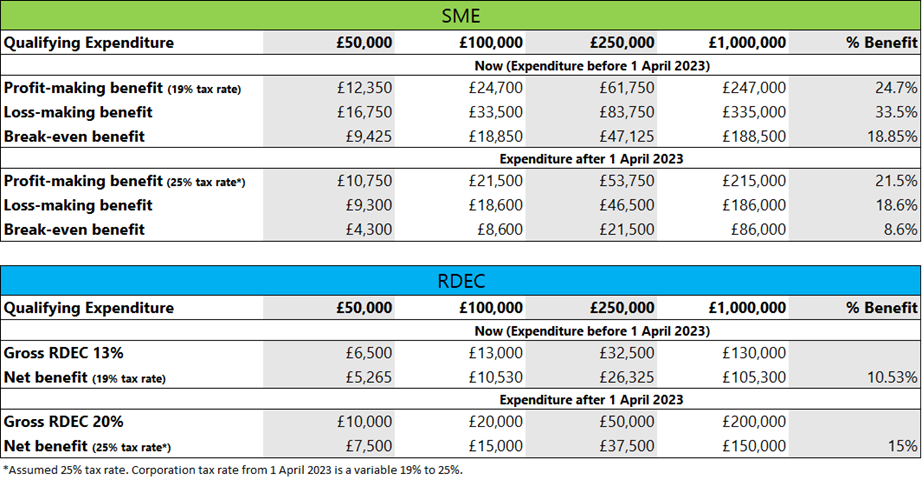

The RDEC scheme has become more generous, with the pre-tax payable credit increasing from 13% to 20% for expenditure incurred on and after 1 April 2023.

Claims made under the SME scheme face a reduction in the R&D tax relief for expenditure incurred on or after 1 April 2023. The enhanced deduction, which is the additional amount of relief deductible for tax purposes, will reduce from 130% to 86%. Losses that are surrendered for a tax credit under the scheme will be payable at a reduced rate of 10%, down from 14.5%.

As of 1 April 2023, Corporation Tax will change to a variable rate between 19% to 25%, dependent on profitability levels. Companies with profits under £50,000 will remain at a rate of 19%, and the tax rate for companies with profits over £250,000 will rise to 25%. Between these two levels of profit a system of marginal relief will apply to companies paying Corporation Tax between 19% and 25%. Taking this into consideration, we recommend consulting with a qualified advisor to help maximise the value and benefit of your claim. Examples assuming a 25% tax rate are shown in the table below:

More changes relating to the R&D scheme are expected within the near future as there is a 2-month review taking place concerning the announced changes and merging of the SME and RDEC schemes.

How the changes affect your Company

If you are concerned about how the above changes may impact your ability to utilise the R&D scheme, or you would like to receive further information, please contact a member of our team. They can help calculate how the changes may affect your subsequent R&D claims and help to maximise your benefit.