On Wednesday 15 March, the Chancellor announced tax policy changes in the Spring Budget which included further changes to the R&D scheme. We have summarised the key changes and announcements below, highlighting how these could impact your future claims.

Claiming overseas expenditure

It was previously announced that for accounting periods starting on or after 1 April 2023, expenditure for overseas subcontractors or externally provided workers (EPWs) would no longer qualify for R&D tax relief. The aim of the measure was to refocus and promote innovation within the UK.

This change to the scheme will be delayed and will now come into effect for accounting periods starting on or after 1 April 2024. This is to give the Government time to consider the restriction and the design of the potential merged R&D relief combining the SME and Research and Development Expenditure Credit (RDEC) schemes.

This is a great result for businesses. Before the change a lot of companies faced the double hit of a reduction in qualifying R&D categories and the reduction in the R&D relief for SME schemes. With this delay it does allow another year for businesses to claim back overseas costs, and another year to look to transition R&D activity into the UK.

Provision of additional information

The requirement to provide additional information will come into effect for claims made on or after 1 August 2023.

This new requirement is to provide additional information via an online form. The information required is already covered in our reports at the level of detail HMRC will require.

We expect the format of these forms to be published shortly.

Additional Tax Relief for R&D Intensive SMEs

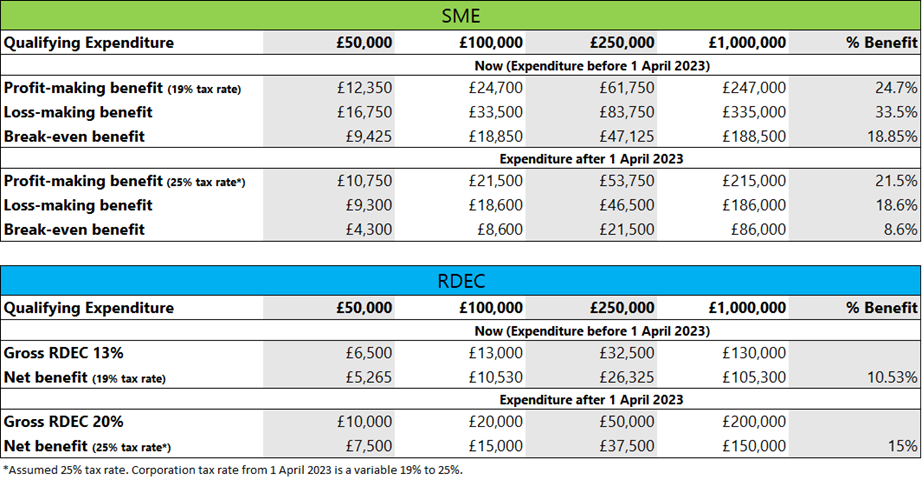

As announced in the Autumn Budget 2022, the enhanced deduction for SMEs, will reduce from 130% to 86% for expenditure on or after 1 April 2023. Losses that are surrendered for a tax credit under the scheme will be payable at a reduced rate of 10%, down from 14.5%.

These changes significantly impact loss making companies, reducing the benefit from 33p in the £ to 18p in the £. This change has been widely condemned by business groups, think tanks, and tax advisors as it largely affects early-stage innovative companies.

In this Spring 2023 Budget, the Government have announced a new rate for R&D intensive SMEs with a payable tax credit at 14.5%. With the reduced enhanced deduction of 86% this would mean a benefit of 27p in the £.

To qualify for the additional tax relief, a company must satisfy a new R&D intensity criterion. This is the ratio of the company’s qualifying R&D expenditure for a period to its total expenditure for the same period. An SME will be eligible if their R&D intensity is 40% or above in the period.

The additional relief will be available for expenditure on or after 1 April 2023, however, the legislation is not yet in place for this relief and is not expected to be in place until summer 2024. Companies who qualify can still apply for an R&D claim prior to this at the current 10% payable rate, and will be able to amend their return for the additional rate once the legislation is in place, or can choose to delay submission until the legislation has come into operation.

Other notes

Recently the House of Lords Finance sub-committee published a report into the R&D schemes. We are still awaiting the Government’s response, but the report does criticise some Government proposals, such as the pre notification requirement. Breakthrough Associates have submitted a detailed and comprehensive input into this review.

The Government’s consultation into a simplification of the R&D relief by merging the SME and RDEC schemes closed on the 13th March. The Government intends to publish the results of the consultation in the summer. We shall update you in due course.